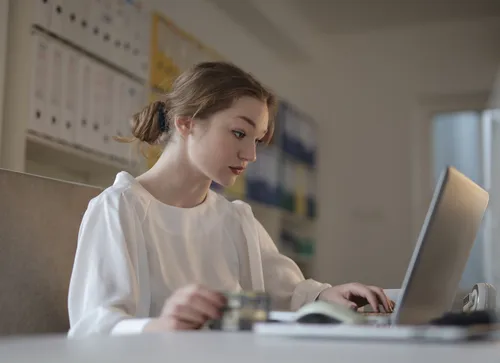

Unlike CPAs or medical professionals, anyone can call themselves a “financial planner” or a “financial advisor” despite their educational background and professional experience. Because of this, not all of them are impartial in their advice. Likewise, not every one of them always behaves in their client’s best interests. Selecting an economic consultant can be difficult.

Effective Financial Planner Qualifications

Many individuals assume that working with a great financial consultant is critical. Financial preparation, such as estate planning and retirement methods, can make or break a person’s economic fate. Here are a couple of points to remember when looking for a financial planner.

1. Planning Credentials

Chartered Financial Planners (CFP) and Personal Financial Specialist (PFS) credentials are extremely acknowledged in financial planning. They show a person’s ability to operate as a financial planner based on their education and experience. CFP and PFS accreditations are offered to those who have satisfied the certification criteria for education and experience in personal financial planning. Besides that, they must pass the license assessments and sign an agreement to follow continuous education procedure standards and demands.

2. Subject Matter Proficiency

Financial advisors are planners, not experts in any certain field. When it concerns tax preparation and evaluation, a financial advisor may not be as proficient as a Certified Public Accountant (CPA) or an Internal Revenue Service Enrolled Agent (EA). On the other hand, Chartered Financial Experts (CFAs) are experts in investing, yet financial experts might lack this expertise. Personal finance professionals can help you attain your financial goals by assisting you with your economic planning.

3. Client Specialization

Financial advisors aren’t just the same, and not all collaborate with the same kinds of customers. Most solely deal with particular groups of customers who have specialized demands. Personal advisors, for example, might specialize in serving only those individuals and families with a certain profession or life stage-related economic objectives like the probate estate management in Surrey UK and net worth that require their services. Inquire if the financial advisor concentrates on assisting only a picked group of clients with specific monetary requirements and objectives.

4. Fee Structure

The financial planner’s payment structure significantly decides whether the client’s interests or their own are better served by the financial advisor. It is necessary to note that fee-only specialists only charge fees for their services. On the other hand, fee-based experts receive payments on the goods or services they propose for you and extra monetary incentives.

To put it another way, the investment advice and tips you receive from a fee-only financial consultant will be extra unbiased and to your benefit. Find an expert whose rate structure is conflict-free and aligned to your advantage.

5. Availability

You need to be able to contact them whenever you need to. Ask your financial advisors if you wish to know how many customers they presently serve and the number of clients they anticipate serving. The number of customers to advisors is an essential consideration when determining whether or not your planner will be available in the future.

Which planning tasks are normally managed by a paraplanner or other junior staff members? Additionally, ask about the planner’s function in the job. Consider ensuring the advisor is available by phone and email during typical work hours.